Jagged Island

The one-stop platform for

Intelligent Quant Trading

Fully programmable models

Powerful multi-asset backtest

Advanced technical tests

Model Validation Workflow

Business RT Position Keeping and Analitics

Active Risk Management

Features

“Jagged Island has everything an enterprise quant trader can ask for”

Jagged Island provides a Model Development Environment (MDE), consisting of an integrated IDE, a plugin for advanced functionalities, and a set of APIs.

Jagged Island’s APIs are designed for developing analysis and execution models with the highest possible level of freedom and simplicity for the end user.

Moreover, our full integration with the IDE makes available a complete unit-testing suite for local tests of your algorithms.

Jagged Island’s Backtest engine is conceived to deliver the highest degree of financial accuracy and to work on multi-asset set (portfolio or multi-portfolio).

Thanks to our approach, you don't need to develop different models for the testing and the trading sessions, but you can directly test your production algorithms through multiple backtests, optimize the parameters and compare the results.

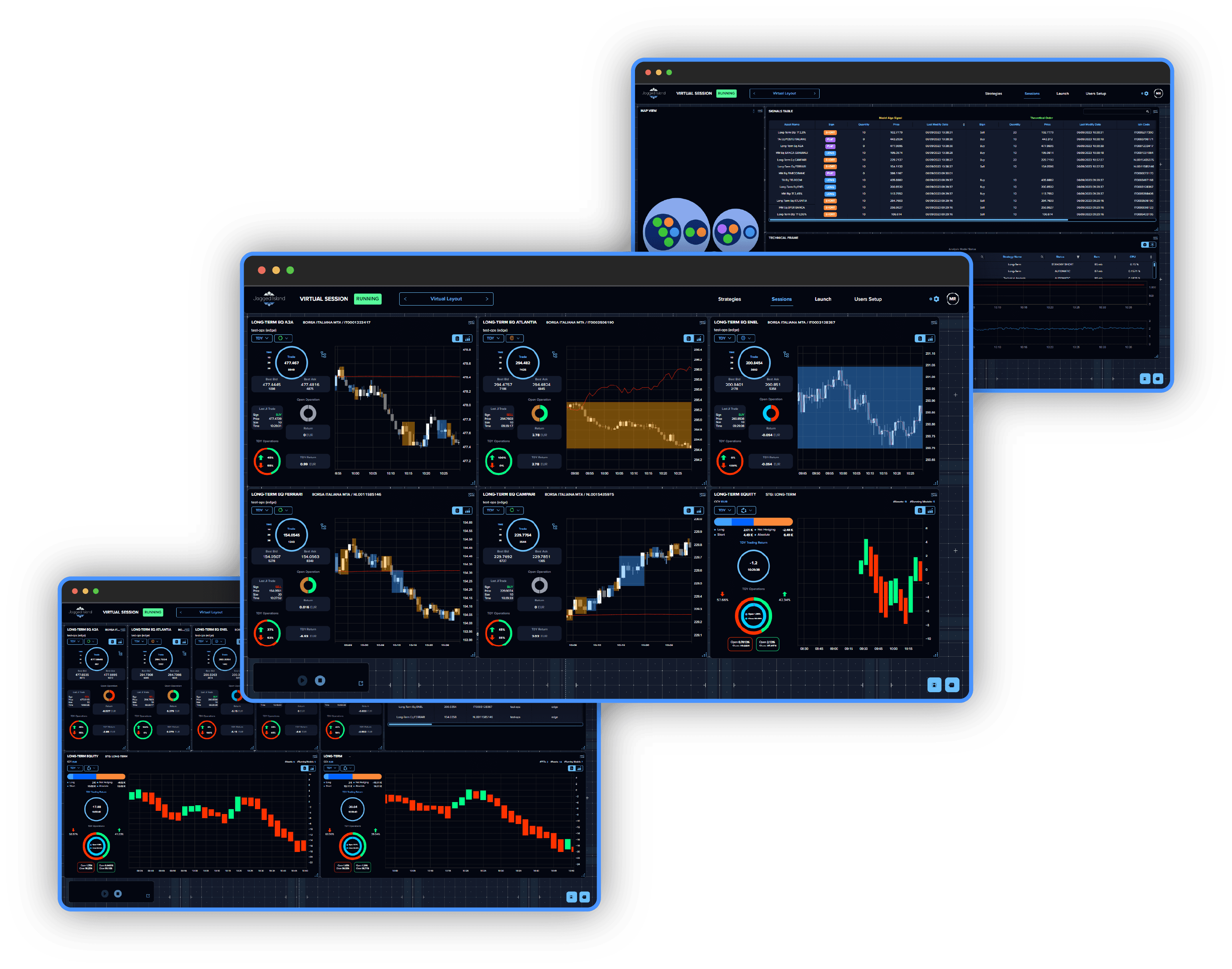

Fail-proof your algorithms performing technical tests through Jagged Island’s Virtual Session. Create technical performance reports and stress your strategies to simulate intensive live scenarios and make sure your system will remain stable in all market conditions.

Position keeping allows real-time monitoring of strategies and their components, performs precision calculations with a level of detail oriented towards quantitative models and AI.

In addition to the calculation of the position, risk and return variables, Jagged Island has a "Business Analytics" module which allows for in-depth analysis of the dynamics concerning the strategies or aggregates of freely chosen assets.

Jagged Island has features and functionalities that make it compliant with Mifid II, it also provides a fully integrated model validation process that allows you to speed up the times for their effective use in production.

Jagged Island allows active risk management both through an active constraint management module and through APIs that allow decisions to be made based on the variables calculated by position keeping.

Other Features

Data Categories

Data categories supported: reference, market, micro, macro, news, alternative, proprietary

Customisations

Highly customisable user experience: The platform allows you to freely organise your workflow using the different environments. Moreover you can configure complex strategies and set up the multi-frame graphical interface according to your needs.

Security

Confidentiality and preservation of users’ data during access and usage. Particular care is devoted to safekeeping trading strategies, which are considered an important intellectual property

Easy Data Access

Streamlined and simplified access to data and trading signals generation

Integrations

Integrable with external systems: Jagged Island is conceived to be opened to integrations with external systems: Data feeds, markets, trading systems, official position keeping can all be seamlessly integrated.

Performance

The system is optimised to ensure fast elaboration through low latency, high frequency and parallel computing frameworks.

Multi Asset

Multi Asset class platform: cross asset class trading can be implemented

AI Friendly

Development features enable the development of AI-based models

Scalability

Flexibility in the number of data feeds, financial instruments, markets and employed trading algorithms. In particular, scalability serves the freedom to develop and then implement any type of trading model or strategy